Quack Quack Quack 🦆🦆🦆

Stablecoins play a crucial role in the Base ecosystem, indicating its robust development and substantial liquidity. However, the abundance of stablecoins can leave users perplexed about which one to choose, considering factors such as safety and liquidity. Here, we provide explanations about the various stablecoins circulating on the Base chain in general and DackieSwap in particular.

-

Native USDC:

-

Address: 0x833589fCD6eDb6E08f4c7C32D4f71b54bdA02913

-

Symbol: USDC

-

This native stablecoin on the Base network is issued by Circle and is expected to have the largest market share on Base in the future. Major centralized exchanges like Coinbase and others will support USDC for deposits and withdrawals.

-

-

USDbC:

-

Address: 0xd9aAEc86B65D86f6A7B5B1b0c42FFA531710b6CA

-

Symbol: USDbC

-

USDbC is a stablecoin bridged from USDC on the Ethereum network to the Base network. Essentially, USDC on Ethereum gets locked in Base's native bridge, and USDbC is issued on the Base network.

-

-

DAI:

-

Address: 0x50c5725949A6F0c72E6C4a641F24049A917DB0Cb

-

Symbol: DAI

-

Similar to USDbC, DAI is issued by Base's native bridge. DAI on the Ethereum network is locked in Base's bridge, and DAI coins are issued on the Base network for users.

-

-

axlUSDC:

-

Address: 0xEB466342C4d449BC9f53A865D5Cb90586f405215

-

Symbol: axlUSDC

-

The first stablecoin was issued on the Base network by Axelar Network. It is backed by a liquidity pool and has good initial liquidity. However, it may gradually lose market share to Native USDC and USDbC. Axelar also supports axlUSDT on the Base network.

-

In terms of security, below is our evaluation.

Native USDC > (USDbC & DAI) > (axlUSDC & axlUSDT)

-

Native USDC is issued by Circle and can be exchanged for USD directly with Circle.

-

USDbC & DAI have a minimal risk if Base's Native Bridge is attacked, which is unlikely but not impossible.

-

axlUSDC & axlUSDT may have risks related to attacks on Axelar's cross-chain bridge liquidity pools. Users should conduct their own research (DYOR) before using these stablecoins.

Please be aware that when utilizing Base's Native Bridge to transfer assets from Base back to Ethereum, the transaction processing may take up to 7 days due to the utilization of Optimism Rollup technology. Alternatively, users have the option to use third-party bridges like Stargate or Orbiter for immediate asset bridging, albeit with associated fees and a slight slippage that varies depending on the chosen bridge.

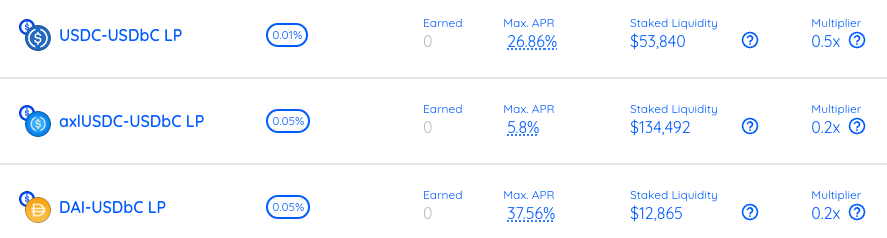

Users can also profit by providing liquidity for stablecoins on DackieSwap, where we offer three stablecoin pools with attractive rewards.

🤫 DackieSwap’s native USDC - USDbC pool boasts the lowest transaction fee tier (0.01%) and high rewards. We hope this article helps users understand the different types of stablecoins, their safety, and how to use them effectively.

Quack Quack Quack 🦆🦆🦆